A growing number of U.S. expats are making the difficult decision to renounce their American citizenship. The reasons are clear based on recent surveys: complex tax obligations, rising costs, and dissatisfaction with governmental policies are making life as a U.S. citizen abroad increasingly challenging. For many, obtaining a second citizenship in the Caribbean is emerging as a compelling alternative.

The Tax Burden of U.S. Citizenship Abroad

Under laws like the Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank Account Report (FBAR), U.S. citizens must report foreign income and assets, regardless of where they reside. This dual tax burden often results in expensive and complicated filing obligations. Many expats report feeling unfairly treated compared to their U.S.-based counterparts, as the system offers little relief from double taxation.

Recent policy proposals have only added to the anxiety. Plans to raise individual and corporate tax rates, coupled with strict enforcement of existing laws like the 2017 repatriation tax provision, are driving home the financial implications of U.S. citizenship for those living abroad.

The Appeal of Renouncing U.S. Citizenship

Beyond taxes, cultural and personal ties to new home countries often lead expats to reconsider their U.S. citizenship. They seek a sense of belonging in their adopted nations and want to simplify financial and bureaucratic processes that U.S. citizenship complicates.

However, renouncing citizenship is not without its own challenges. From the exit tax to the potential for being barred from re-entering the U.S., the process is fraught with pitfalls. Professional guidance is crucial to navigating this complex journey.

How Caribbean Citizenship Simplifies Life

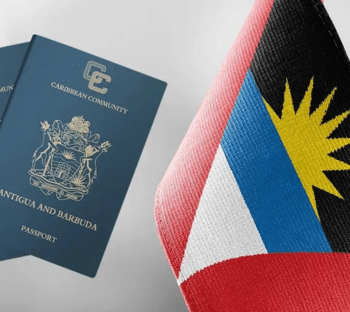

For those exploring alternatives, the Caribbean offers a range of attractive citizenship-by-investment programs. These programs provide a path to greater financial freedom, enhanced mobility, and reduced tax burdens. Nations like Antigua & Barbuda, St. Kitts & Nevis, and Dominica offer straightforward processes for obtaining citizenship through investment, with benefits that include visa-free travel to numerous countries and tax-friendly environments.

By acquiring Caribbean citizenship, expats can enjoy the advantages of a new national identity while freeing themselves from the complexities of U.S. tax obligations. It’s a strategic solution that combines personal and financial benefits.

Take the Next Step

Renouncing U.S. citizenship is a major decision that requires careful consideration and expert advice. For those considering this step, Caribbean citizenship offers a practical and appealing alternative.

At Citizens International, we specialize in guiding individuals through the process of obtaining second citizenship in the Caribbean. Our team is here to help you explore your options, understand the benefits, and take the next steps with confidence.

Read more on our website to learn more about Caribbean citizenship-by-investment programs or schedule a free consultation with our experts. Let us help you achieve the freedom and simplicity you deserve.