Citizenship by investment in 2025: why families choose it, and the Caribbean advantage

Families pursue citizenship by investment for practical reasons. They want reliable mobility, a secure plan for periods of instability, and a second home base that does not depend on one country’s politics. Many also value easier business travel, education choices for children, and a clearer path to relocate if circumstances change.

CBI programs can offer direct citizenship with defined timelines and costs. There is no long residency ladder, and in most cases there are no language or physical presence requirements. The result is certainty. Applicants know what is needed, how the process works, and when to expect an outcome.

Some EU institutions question Caribbean CBI. At the same time, several member states have widened and accelerated naturalisation at home, including Germany in 2024. The point here is consistency, not criticism.

Quick look beyond the Caribbean

There are non-Caribbean paths to citizenship or accelerated naturalisation, but each comes with trade-offs on cost, travel utility, or clarity.

-

Turkey. Real estate purchase from 400,000 USD held for three years, or select financial investments from 500,000 USD. Processing can be relatively quick. Travel access is solid but not comparable to top Caribbean passports.

-

Egypt. Multiple options exist. A 250,000 USD non-refundable contribution, a 300,000 USD qualified real estate purchase, a 350,000 USD business investment plus a 100,000 USD donation, or a 500,000 USD bank deposit returned after three years in local currency. Travel access is more limited than top CBI peers.

-

Vanuatu. Donation routes have been available, but the EU ended visa-free access in 2024 after a long suspension, which reduces travel value for many investors.

-

Europe, generally. Investor routes tend to be residency first and are costly. The UK investor visa is closed to new applicants. The Netherlands investor route was abolished in 2024 after years at a seven-figure threshold. Greece remains a residency program with higher real estate thresholds, now around 800,000 euros in prime zones and 400,000 euros elsewhere.

Caribbean alignment and what that means

The five Eastern Caribbean programs coordinated standards in 2024, including a shared minimum investment floor of at least 200,000 USD and stronger information sharing. This raised consistency and addressed many of the concerns voiced by external partners.

Same due diligence firms, wherever you apply

Independent third-party providers conduct background checks for Caribbean programs, as well as global citizenship or naturalisation programs. These are the same categories of risk and compliance firms used by governments and financial institutions worldwide. In the Caribbean, the checks typically include identity verification, source of funds analysis, database and open-source screening, and in several programs formal interviews for applicants 16 and over.

Why the Caribbean often makes more sense in practice

-

Entry thresholds remain competitive against Europe while delivering direct citizenship rather than a long residency ladder.

-

Processing is measured in months for many applicants, with no ongoing physical residence typically required.

-

The same class of third-party due diligence providers is engaged, and interviews now feature in several programs.

-

Strategic location, steady connectivity, and high quality of life for families.

Current Caribbean entry points and highlights

Exact totals vary by family size, route, and fees. The current entry figures are below, plus a few practical notes to help readers think beyond price.

-

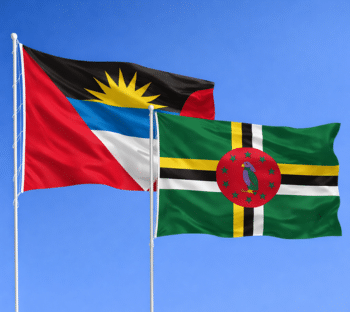

Antigua & Barbuda. From 230,000 USD. Well suited to families. Options include contribution or approved real estate. Processing typically measured in months.

-

St. Lucia. From 240,000 USD. Multiple routes including real estate and government instruments.

-

Dominica. 200,000 USD for a single applicant and 250,000 USD for a family of four. Formal interview introduced for applicants 16 and over, which strengthens vetting.

-

St. Kitts & Nevis. From 250,000 USD. The pioneer program with strong global recognition.

-

Grenada. From 235,000 USD. Offers real estate and contribution routes. Popular with families who want flexible planning.

Antigua case study: lifestyle, growth, and connectivity

Antigua is the most popular choice among our clients. It’s safe and well connected, with direct links to North America and Europe and strong regional air access via V. C. Bird International Airport. The economy has posted solid growth supported by tourism and construction, holding the fastest growing economy record in the Eastern Caribbean currently. Antigua has moved well beyond a holiday image and is building long-term fundamentals for residents and investors.

A realistic note on EU policy

EU institutions continue to refine the visa suspension mechanism, adding grounds to target countries that operate investor citizenship schemes. That scrutiny makes the Caribbean’s stricter alignment and due diligence even more important, and it is exactly where these programs have moved during the last 18 months.

Who is applying and why

We see consistent demand from Europe and North America. Motivations are practical. Reliable mobility, a family safety plan in an uncertain geopolitical cycle, and a clear, vetted process that avoids the long residency ladders common in Europe.

Next step

If you want a clear side by side for your family, we can model total costs, timelines, and route selection across Antigua & Barbuda, Dominica, Grenada, St. Kitts & Nevis, and St. Lucia, and set that against European residency plans such as Greece.

We would love to talk. Book a complimentary, personalised consultation to plan the right path for your family’s future: citizensinternational.com/consultation.