A 2024 report reveals that nearly 40% of U.S. millionaires plan to buy a home overseas in the next 12 months.

This plan is a strategic move for high-net-worth individuals who want to diversify their assets and tap into more real estate markets. It is also a way to secure a plan B (especially if second citizenship is an option) and be one step closer to having a better lifestyle.

You can also achieve this goal this year if investing in a home abroad is part of your plan. However, you must know how to buy property overseas to ensure you make the right decision.

A Guide to Purchasing Property Abroad Smartly

Read our best tips and strategies to invest in the right property overseas:

1. Identify your goals.

Your reasons for buying property in another country should set the foundation for the entire process.

Your goal may be to have a vacation house, a future retirement home, or a rental investment. You can even include obtaining a second citizenship, which can be an important part of your plan B.

When you have your list of goals, you can narrow down your list of the best countries to buy property in and the type of home you need. You’ll avoid costly mistakes and keep your search focused.

It can also make talking with real estate professionals and legal advisors more straightforward and productive.

2. Research your preferred locations.

Take as much time as possible to research the real estate markets you are interested in to ensure you select the best country and property to invest in. Study the average property prices and check the market’s stability.

Research popular locations if you plan to turn the property into a long-term or short-term rental.

Another important part of learning how to buy property internationally is looking into the quality and cost of living, healthcare, infrastructure, and other lifestyle factors. You should also make sure the area is safe, which means checking crime statistics and reports. Research about the country’s political and economic stability as well.

Take the time to understand the local rules around foreign ownership and residency or citizenship requirements, especially if you’re interested in obtaining a Caribbean passport.

Some countries make it easy for foreigners to own property and second citizenship or residency, but others have strict requirements that you may not meet.

3. Check if you can own property in your preferred location.

Rules regarding international real estate investment vary by country, region, or city.

Foreign investors can buy property freely in some countries. In others, you’ll only be allowed to own a home in specific areas.

It is important to understand exactly what kind of ownership is available to foreigners since it will affect your rights and long-term security.

If you are unsure about some details on the listing, speak with the real estate agent or a consultant who can assist you, particularly if you are interested in acquiring citizenship or permanent residency through property investment.

While speaking with the agent or advisor, ask about the residency and citizenship requirements if you do not plan to stay long in the country. For instance, the Grenada Citizenship by Investment program does not have residency requirements, which means you do not have to stay in the country for a specific period to keep your citizenship status.

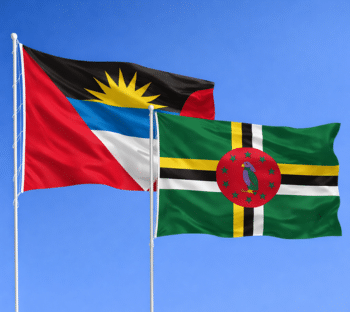

In Antigua, non-citizens purchasing property have different taxation; which is another benefit of pursuing citizenship by investment if you’re interested in an approved property or development.

4. Assess your financial situation.

Since you are making a substantial investment, ensure you have enough money for buying property abroad, especially if you are paying the full amount in cash.

Speak with your financial advisor about your plans to purchase a home overseas. Go over your assets and discuss how this will affect your finances.

You should also discuss your options if you want to take a loan or use other financing strategies.

Make sure you know all the expenses that come with purchasing property overseas. These include taxes, maintenance requirements, and processing fees.

You also have to pay additional fees to your property advisor or citizenship advisor if you work with one.

5. Understand the conditions and rules for renting out or reselling the property.

When purchasing property abroad, find out if you are allowed to turn it into a holiday or long-term rental for additional income. This can help you earn your investment back faster and avoid having an idle asset.

Analyze the previous years’ long-term real estate trends if you plan to resell the property. Pay attention to price fluctuations, demand cycles, and how external factors like politics or the economy have affected the market.

Find out if there is a required period of ownership before you can resell the home. For instance, if you buy property in Dominica through the Dominica Citizenship by Investment program, you can only resell it three years after purchasing it.

6. Consider visiting your preferred properties and locations.

Online research and virtual tours can only show you so much when buying luxury property abroad. As such, take a trip to your chosen country if possible.

Visit different properties and neighborhoods to get an idea of the lifestyle and vibe in your possible new home. Check its accessibility and amenities, and speak with locals to know if you’re moving to a friendly and safe area.

Make sure you inspect the property thoroughly, especially if you are buying one by the beach.

Have your real estate agent or property advisor arrange a property viewing schedule so you can visit as many homes as you can during the trip.

7. Work with a trusted advisor.

Once you have decided which country to buy a home in, look for a property advisor to narrow down your options. They can help you find the ideal property faster since they already have a listing of houses, villas, apartments, and condos.

A qualified property advisor has a listing of government-approved properties if you are interested in owning a home in the Caribbean through the Antigua and Barbuda Citizenship by Investment program.

Licensed advisors can assist you with the entire investment process. They can also be your representative if you can’t travel to speak with the property seller during your second citizenship or residency application.

Some citizenship consultancy firms in the Caribbean offer both real estate, citizenship, and residency advisory services. Consider getting assistance from these companies, only to have a single point of contact and receive consistent advice.

Buying property overseas is a big step, whether you’re a seasoned or first-time real estate investor. Work with a qualified advisor to ensure you go through the process successfully.

Speak with one of our advisors to get more details about buying property in the Caribbean.