Ah, the Caribbean – a region known for sparkling turquoise waters and pearly white beaches. It has some of the richest cultures in the world and is home to many expatriates who wish to spend their golden years in the sun.

The good news is that your retirement can also be as peaceful as theirs, thanks to Caribbean second passport programs.

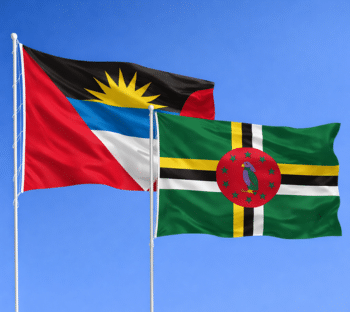

Citizenship by investment programs (CIPs) offer foreign nationals a chance to become legal citizens in Caribbean countries, such as Grenada, Dominica, and Antigua and Barbuda. These programs also grant investors other benefits that range from visa-free travel and tax perks.

Want to retire and live the Caribbean dream? Here are some questions you need to answer to make an informed decision:

Why do you want to live in the Caribbean?

Before anything else, you need to think about your reason for deciding that the Caribbean is the best place for your retirement.

Is it because of the delicious cuisine and year-round access to fresh seafood? Or perhaps you’re after the beautiful weather, gorgeous beaches, and friendly locals? It can also be the visa-free travel benefit you get from becoming a Caribbean citizen.

Whatever your reason may be, it is important that you keep that in mind when looking for a country in the region to serve as your home during your golden years.

Where do you wish to live?

Now that you have a cause for retiring to the Caribbean, it is time to choose a specific country to invest in.

You have several excellent options for Caribbean citizenship by investment, like the twin islands of Antigua and Barbuda, the Spice Isle of Grenada, and the oldest CIP country of St. Kitts and Nevis.

Choosing where to retire is a big decision, so you’ll have to think about it more thoroughly. To help you make a smart choice, below are a few more questions you can ask to see whether the nation and its CIP suit your needs:

Does it match my future goals?

When you’re retiring, you’re not just going to sit back all day and wait for the sun to set (as gorgeous as the view in the Caribbean may be). You will still need to do something and have a specific goal in mind for the future during your retirement.

Those goals are crucial factors to consider when choosing a country in the Caribbean.

Are you planning to expand your business to pass on to your family? Do you like traveling to other places without having to apply for a visa for every single one of them?

Are you focused on planning for your children’s education and future? Are you looking for a place to protect your wealth and assets? Or perhaps you’re concerned about the taxes?

After answering questions like these and understanding what they mean for you, you can match the details of your retirement plans to them. Having specific goals also helps make choosing citizenship by investment program easier, compatibility-wise.

How much is the cost of living?

Another important aspect you need to understand before making a final call on what country you will spend the rest of your life in is the cost of living.

Retirees often choose countries with the least impact on their finances, and for a good reason. Adjusting to a new life is already overwhelming without having to worry about the adjustment in their expenses.

When analyzing a place’s cost of living, you also need to consider your anticipated living situation. Are you buying or renting? Do you plan to own a car, or will you rely on ride-sharing and public transportation to get around?

Plus, there’s also the tax situation to think about. Some countries offset the higher cost of products and services in the area with more favorable tax rules, imposing no taxes on inheritance, capital gains, or income.

Can I bring my family?

When moving to a different country, most people would want to bring their family along. This is especially true for retirees.

The good news is that becoming an economic citizen of the Caribbean often comes with an extension of the privileges to their direct dependents. Some countries in the region cover an investor’s legal spouse and dependent children up to a certain age. Others also cover parents, siblings, in-laws, and even adult or adopted children.

But remember that some do not have this advantage, so make sure you always check this detail before applying if you plan to bring your family.

Is the country safe and stable?

Finally, you need to research how safe and stable the country is.

Safety concerns are one of the top priorities of retirees because they feel more vulnerable than they used to. Plus, the very reason they are moving to the Caribbean is to enjoy their golden days, so it makes sense to want to go somewhere peaceful and crime-free.

Besides crime statistics, make sure you check the country’s economic and political stability as well. In this aspect, you’ll be glad that most CIP countries in the region are relatively stable.

As a bonus, you’ll be able to join a diverse ex-pat community and be part of a place where locals are friendly and welcoming to everyone.

Enjoy Your Golden Years

Enjoying your golden years to the fullest is a matter of choice. You’ve done so much in life to deserve the best retirement possible, so don’t hesitate to spend it in a gorgeous Caribbean nation. Let us help you do just that through Caribbean citizenship by investment. Reach out to us for more information.