High net-worth individuals or those with at least USD 1 million in cash or cash-equivalent (i.e., liquid) assets have many investment options. One of these options is acquiring a second citizenship via real estate investment.

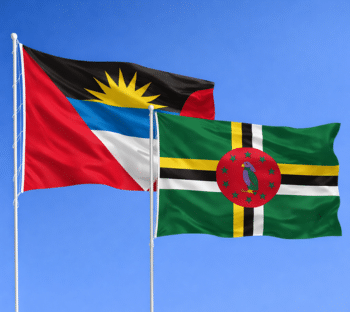

4 Caribbean Countries with a Second Citizenship by Real Estate Investment Program

The following Caribbean countries have a citizenship via real estate purchase option. Note that the figures indicated below cover only the actual value of the real estate. Your total investment will be the cost of your real estate purchase plus government dues, contributions, and processing fees.

1. Antigua and Barbuda

Through the Antigua and Barbuda citizenship by investment program, you can apply for citizenship if you invest in real estate with a value of at least USD 400,000. You can also invest jointly with a related person, as long as each of you invests at least USD 200,000.

2. St. Kitts & Nevis

In St. Kitts & Nevis, the citizenship by investment program has two real estate purchase options for high-net-worth individuals.

The first option is buying property worth at least USD 200,000 in a government-approved project (e.g., an apartment in a resort complex), which you must hold on to for at least seven years.

The second option is purchasing a titled property (e.g., a detached villa) worth USD 400,000. In this case, the USD 400,000 minimum applies to the building alone, so the land cost will not be considered in the calculation of your real estate investment.

3. Dominica

The Dominica citizenship by investment program allows individuals to apply for citizenship by purchasing real estate worth at least USD 200,000.

You may not sell the property for three years from the date you got your citizenship. And, you can only sell it under the citizenship by investment program after five years.

4. Grenada

You may acquire citizenship through the Grenada citizenship by investment by purchasing property worth at least USD 220,000. The property must be part of a real estate project approved by the government for citizenship via real estate investment purposes.

Why Choose Citizenship via Real Estate

Citizenship by investment programs differ by country. Typically, however, applicants for a second citizenship have the following options:

- Government donation

- Real estate purchase

- Investment in a new or existing business or fixed-capital investment

- Bank deposit or asset transfer, with asset lockdown

- Acquisition of shares in government-approved funds

High net-worth investors have various options to obtain citizenship, in other words. Why choose citizenship via real estate investment?

1. Gain Equity

Government donations are a more affordable route to gaining second citizenship, making a donation the more accessible option. However, it’s wiser to purchase real estate than to donate.

Money donated is money lost, so to speak. Consider it gone because you cannot recoup it.

When you invest in real estate, you gain equity. Yes, you will be unable to sell such real estate for several years, typically for five years. But the property remains yours even while you can’t sell it.

If you pass away, your heirs can inherit your property. They cannot do the same with your donation.

2. Earn Returns

Even if you cannot sell your property, you can lease it out for the long term or rent it out for the short term. This will let you generate monthly income from your real estate asset. This possibility is particularly attractive to investors in the Caribbean.

You can buy real estate under the Grenada citizenship by investment program or the Antigua and Barbuda citizenship by investment program. Doing this will not only get you citizenship in either of these countries. You will also get to own property in a high-tourist-traffic location.

Such a real estate investment gives you high earning potential. If your rental business goes well, you might even be able to recoup your investment before your holding period is over.

3. Relatively Affordable

Two hundred thousand dollars is no small sum. However, it is more affordable compared to the amount of investment required to invest in a business (which could run up to millions).

Therefore, a real estate purchase is the more accessible option when compared to investment in fixed capital or existing business ventures. Your real estate investment will let you earn returns on your investment just like an investment in a business or fixed capital would. But it won’t cost you nearly as much.

4. Capital Preservation and Appreciation

Even if you do not rent out your property and just use it as your second home, you can still realize capital gains from property appreciation.

Property prices can and do fall during recessions, but they are often resilient and typically bounce back after a period of depression. Investing in real estate is, therefore, a good way of preserving and even appreciating capital.

Invest in Real Estate and Earn a Second Citizenship

On the lookout for a way to utilize your liquid assets? Consider investing in real estate. And instead of investing in real estate in your home country, consider leveraging your real estate purchase so it qualifies you for citizenship in another country.

Take advantage of the many citizenship by investment programs available. There’s the Antigua Barbuda citizenship program, the Grenada citizenship program, the Dominica citizenship program, and the St. Kitts and Nevis citizenship program. And that’s just in the Caribbean alone.

All four of these Caribbean countries have a citizenship via real estate investment route. Contact us to discuss your options now.