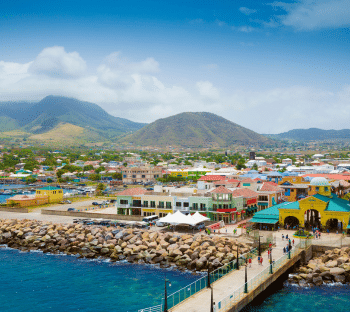

A Comprehensive Guide to Banking in Antigua and Barbuda

In this article, we will explore the banking landscape of Antigua and Barbuda, providing valuable insights into the process of opening a bank account in this jurisdiction, showcasing the available banking options, and offering a balanced view of the advantages and disadvantages to help you make an informed decision about whether Antigua and Barbuda is the right financial hub for your needs.

Benefits of Antigua and Barbuda Banking

Antigua and Barbuda are home to a diverse range of both national and international banks that offer foreign currency accounts, making them particularly appealing for individuals seeking to engage in global financial activities. Notably, Antigua and Barbuda, as a Commonwealth country, operate under a common law legal system and primarily use English as their official language.

Since 2019, Antigua and Barbuda have maintained a favorable 0% individual income tax rate, making them an attractive destination for various financial endeavors. Additionally, the country offers citizenship through investment programs, providing access to passports with significant global influence.

Overseeing the operations of offshore banks in Antigua and Barbuda, the Financial Services Regulatory Commission (FSRC) serves as the single regulatory authority for all non-bank financial institutions. The FSRC also plays a pivotal role in governing the formation of International Business Companies (IBCs).

Who Should Consider Banking in Antigua and Barbuda?

Antigua and Barbuda have made significant strides in improving their ease of doing business, making them a suitable destination for startups and entrepreneurial ventures. Notably, when it comes to opening an account in an Antigua and Barbuda bank, it is your national identity, rather than your place of residence, that takes precedence. Therefore, a current and valid passport serves as the primary identification document. Additionally, the convenience of online account setup eliminates the need for physical presence, although supporting documents may be requested via email or postal mail.

Whether you are a resident or non-resident, the Antigua and Barbuda banking sector offers practical solutions. Commercial banks in the jurisdiction provide robust online banking services, facilitating remote account access.

Opening a Bank Account in Antigua and Barbuda

The process of opening a bank account in Antigua and Barbuda involves several key steps. First, establish contact with your chosen bank, whether it is a local institution or an international bank, and familiarize yourself with their specific rules and regulations. Banks typically require a comprehensive banking history, demonstrating a minimum of three years of account maintenance with another financial institution. Credit references or a letter of recommendation from a trusted business associate, with whom you have had a relationship for at least three years, may also be acceptable.

Demonstrating the source of your funds is a critical aspect. Rental agreements, employer references, or other supporting documents may be required to verify your income. Identity verification entails presenting a driver’s license or passport, while proof of residence necessitates providing a recent utility bill (no more than three months old).

Different entity types, including corporate entities, limited partnerships, trusts, and foundations, have specific documentation requirements, including certificates, agreements, and organizational charts. An initial minimum investment of at least $400 is typically required, with varying deposit amounts depending on the type of account you choose.

Top Banks in Antigua and Barbuda

Antigua and Barbuda are home to a diverse array of banks, numbering in the double digits. To determine the most suitable bank for your needs, it is advisable to visit the official websites of each institution. These banks include both commercial banks and those offering offshore banking services within the Eastern Caribbean Region. Some noteworthy options to consider include:

ACB Caribbean: Previously known as Antigua Commercial Bank, it transitioned to ACB in March 2021 and boasts an asset base exceeding $1 billion XCD.

Eastern Caribbean Amalgamated Bank: This commercial bank provides a range of personal and commercial banking services.

CIBC FirstCaribbean International Bank: As a Caribbean subsidiary of the Canadian Imperial Bank of Commerce, this bank has a presence in Antigua and Barbuda, along with its headquarters in the Bahamas.

The Antigua & Barbuda Development Bank: Based in the capital city of St. John’s, this institution focuses on medium- and long-term development financing for productive sectors, contributing to unique projects such as the export of Antigua Black Pineapples to Norway.

Please note that this list is not exhaustive, and inclusion does not imply endorsement. Comprehensive research is essential to select the bank that aligns most closely with your financial objectives.

Conclusion

Antigua and Barbuda, characterized by stability and the use of the Eastern Caribbean Dollar, have garnered increasing attention as an offshore banking jurisdiction, primarily due to their advantageous tax system featuring a 0% income tax rate and various incentives. The process of selecting the right bank and jurisdiction can be time-consuming and complex.

If you are interested in opening an offshore bank account, exploring Caribbean citizenship programs, or seeking legal tax reduction strategies for yourself or your business, our team of experts is equipped to provide guidance and assist you in navigating your financial journey. This expert assistance can help you save both time and effort as you embark on your financial endeavors in Antigua and Barbuda.